We all know the common things to consider when choosing a battery analytics company, such as expertise and experience. What do you view as the most important factor that most companies overlook?

Even an experienced analytics company with no prior specific experience with batteries is going to have a steep learning curve, vs. a battery analytics company. A deep knowledge of the entire battery ecosystem is critical. What do I mean by that?

First, batteries are unique in that they produce much more data, sometimes 200 times more data per kilowatt hour than any other grid connected devices. The economics of handling that data are quite different than in wind, solar or thermal applications. For example, even though battery data can often be boiled down to voltage, current, and registers at every time point, BMS systems and battery cyclers do not use the same formats. Normalizing data is often time consuming and beyond the skill sets of many companies. A good battery analytics company will be able to offer automated data capture from the testing portion of the line, test harness data collection, and commission baselines (for algorithm tuning), in order to achieve advanced, real-time BMS data analytics.

Second, intuiting expected battery performance is by no means a given and completely depends on the ways batteries are implemented. Is it a power battery or an energy battery? Is its function peak shaving, load shifting or frequency regulation? Models are highly dependent on considerations such as these, and require a deep understanding of how they are best optimized using a high quality dataset driven by automated data capture from the testing portion of the line.

Another important factor to consider when choosing a battery analytics company is knowing whether that company has the expertise to help you monetize your data. Understanding the models, algorithms and economics varies completely based on the use case. Having specialization with the requirements and challenges facing battery OEMs, system integrators, and operators can be the difference between understanding the information your data provides and utilizing it to maximize your bottom line.

In considering a battery analytics company, many emphasize their data analytics capabilities and qualifications. But how important is a deep understanding of the business side?

If analytics are seen as segregated from the business needs, they become nothing more than a research project. For instance, if I have a new battery technology that has a round-trip efficiency (RTE) of 80%, you might not be impressed because you know LMO and LFP have a much higher RTE than this. But what if there was no fire risk and this technology could be produced for $95/kilowatt for five-hour batteries? Well, now you are interested.

Battery storage is not just about capturing as much sun or wind energy as possible. The variety of use cases makes economics essential for understanding the output of any particular algorithm. For example, energy density is a major consideration for electric transportation, but isn’t as much a consideration for the grid (excluding highly specialized edge use cases, such as a UPS in a data center, where space is at a premium).

There is no separation between quality analytics and hard financials. Economic payback is measured in decades for some battery installations, but data from test cells is often just available for months. We track and model batteries over their lifetime at the serial number level, which enables new possibilities that have accretive and demonstrable revenue impact. This includes real-time performance characterization, enhanced warranty management, dynamic residual value calculation in leasing scenarios, dynamic RUL computation, and easy-to-use asset health/degradation scores.

Software analytics projects can often involve long timelines to allow data generalists to ramp up on the specifics of the business. How does working with a battery analytics company impact this process?

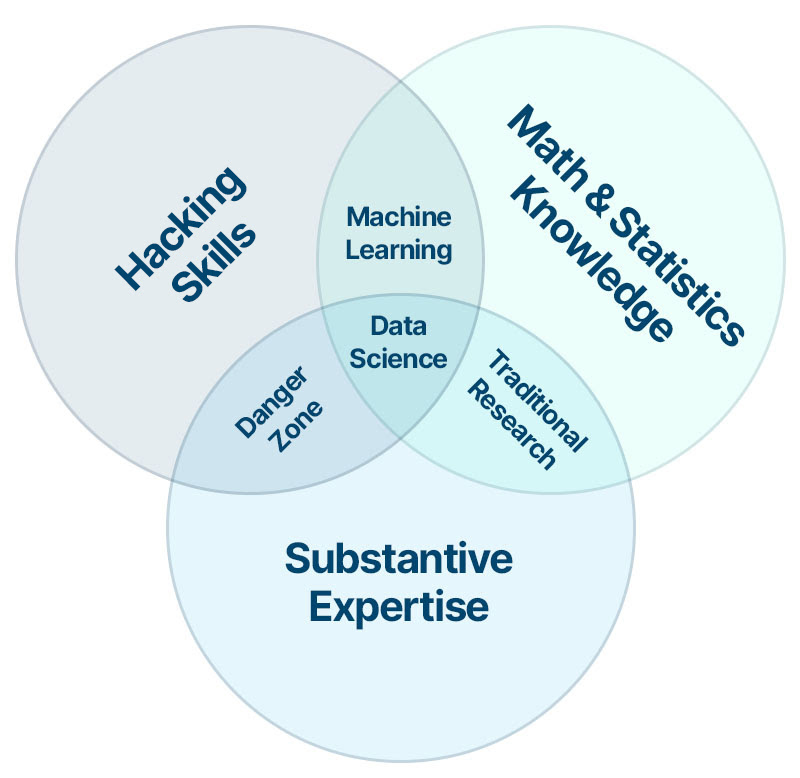

There is a popular data science Venn diagram (pictured below) that does an excellent job of showing how real progress is made when you intersect the skill sets of the data scientist (the algorithm gal), the programmer (the Java guy), and the SME (the battery wiz). So it’s not enough to work with a company that has excellent programmers and data scientists. There is no progress without the SME in that scenario, and lacking one can mean you end up with an expensive solution with limited applicability at best, or at worst having to go back to the drawing board with another partner.

What are some of the lessons learned from working with battery customers that more general analytics companies might not have experience with?

Battery storage technology is in its early days, even for the market leaders. Companies are still struggling to understand how much data to keep, how to keep it, and what to do with it. Normalizing data is still an issue, despite the valiant efforts of SunSpec. What to test at the manufacturing facilities is still the subject of discussion. For instance, some people have wholeheartedly adopted tomography for every battery, while others haven’t. How do companies involved with imaging analyze that vast amount of data still under discussion? Grid operators may do something as basic as calculating the remaining useful life of an installation is quite complex and uncertain.

A general analytics company might take IV data from the last two years of a facility primarily used for load shifting and be able to extrapolate some values about degradation. What if the operator wishes to bring a new technology on line for load shifting and wants to use the legacy facility for peak shaving instead? That same analytics company would have nothing to offer vs. a battery analytics company in calculating NPV for them because it is so closely tied with the specifics of battery storage data science.